This post may contain affiliate links. For more information, please read my disclosure policy.

Let’s talk for a second about personal finance as classical homeschoolers. As we go about planning our school year, have you put much thought into how to teach your kids about the more mundane skills like cooking, cleaning, and maintaining a budget?

I have to admit, I’ve been guilty of skipping them at times, especially teaching kids about personal finance and maintaining a budget.

They don’t fall into what I consider homeschooling since I tend to categorize these skills under parenting instead.

But the skills are still critical. And not teaching my kids how to cook, clean, or balance their budget will hamper them in their adult life.

They won’t have the skills they need to thrive as adults in our society!

Cooking is easy to fix. I have the kids help me in the kitchen while I cook dinner and encourage them to bake cookies. And cleaning works the same way. I have the kids give me a hand while I clean the house or assign them a chore each day.

But teaching kids about personal finance is a bit more challenging.

So I wanted to find a curriculum that would start kids at the beginning and make it relevant to them.

A curriculum that would help my kids understand how their financial decisions today will affect their future selves tomorrow.

Disclosure: I received Before Personal Finance for free and was compensated for my time in creating this review. All opinions are mine.

How to Teach Kids About Personal Finance

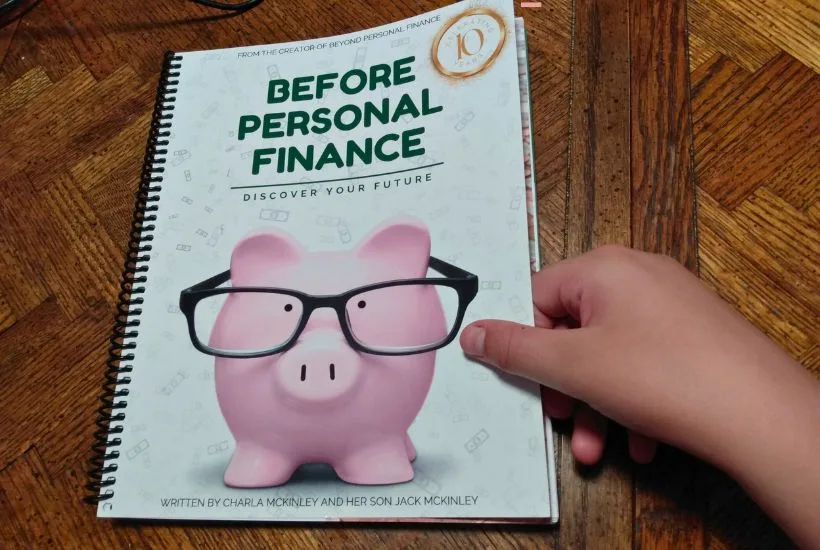

This is why I was delighted to discover Before Personal Finance: Discover Your Future!

Before Personal Finance was developed for kids between 8 and 12 years of age. It’s a fun book that introduces kids to money and goes beyond learning how to count coins.

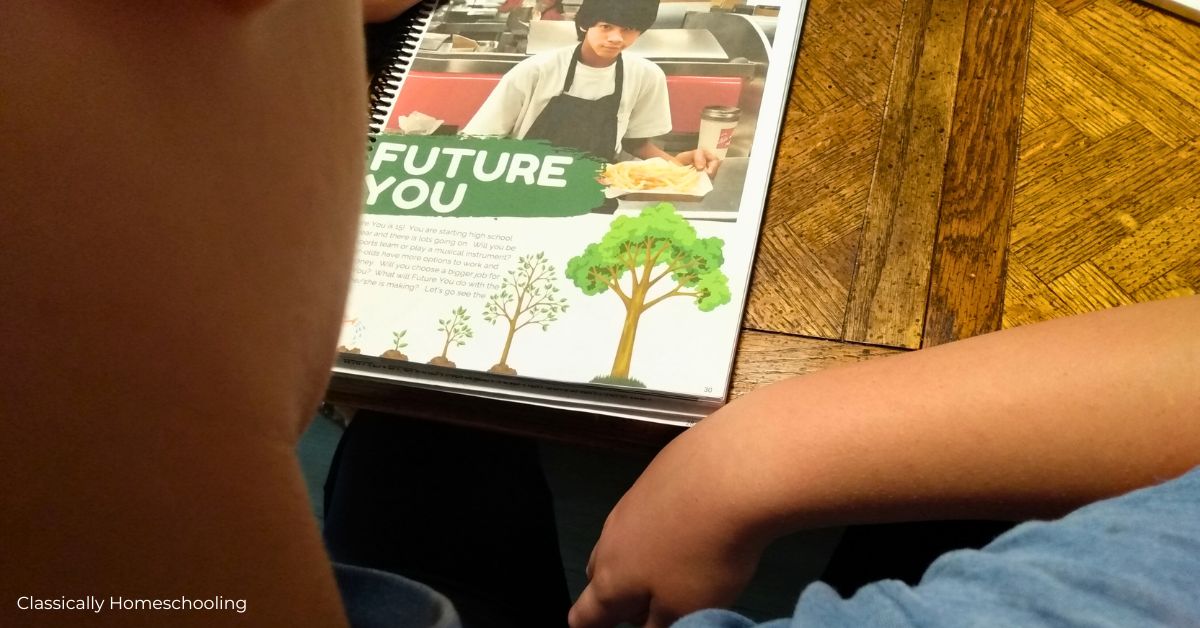

Kids learn how to earn money and look ahead to their ‘future you’. Not their adult self, but rather their teenage self and how they may be mowing yards or babysitting to earn money as a teenager.

The curriculum then walks kids through the process of creating a budget, especially a budget that focuses on the goal of buying a car.

Kids learn about smart spending, generosity, and borrowing money as they look ahead to graduating from high school.

The course includes the basics of money, including earning money and saving along with information about banks, investing, and insurance.

The Beyond Personal Finance Tween (8-12) Curriculum is a delightful introduction to personal finance aimed at giving young children a firm foundation for future learning in a way that kids can visualize.

Kids Design Their Financial Future

The best part of the curriculum is that it walks kids through the basics of personal finance in a manner that kids can visualize.

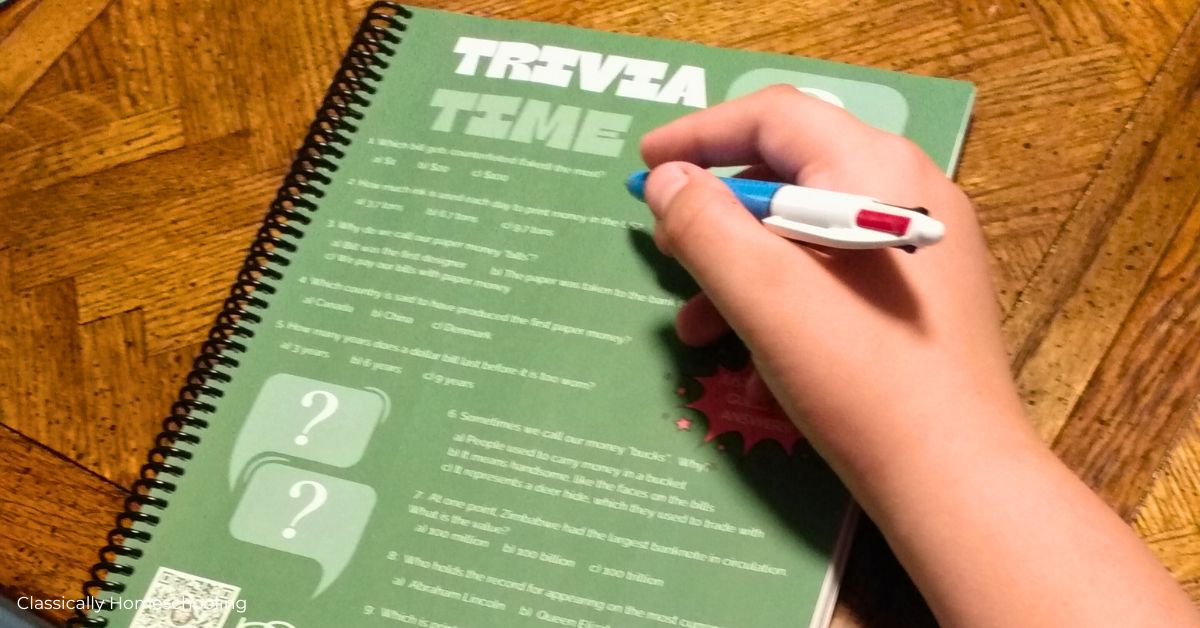

It includes trivia games, crossword puzzles, and cryptograms in addition to teaching kids how to create budgets and plan for future spending!

By the end of the Beyond Personal Finance Tween (8-12) Curriculum, kids have learned how to make a simple budget with money they receive over the course of the year, such as gifts from grandparents and allowances. They have also looked ahead to themselves at 22 and considered future needs such as buying a car and clothing.

I love how Before Personal Finance doesn’t try to throw all the items on an adult’s budget at the kids. Instead, it focuses on items kids can relate to like cars, clothing, food, and pets.

The course also discusses giving money to help someone and saving money.

It walks kids through the basics of what insurance and investing are, and why. By the end of the year, kids understand that personal finance and using their money wisely will affect their future selves. And their quality of life is affected by the quality of choices.

And what better time to start teaching kids about personal finance than now, before they’re dealing with all the obligations of adult life!

Click here to check out Beyond Personal Finance Tween (8-12) Curriculum for yourself!